The ultimate guide to buying a home with full cash payment in Florida.

Are you considering buying a home in Florida with a full cash payment? Whether you’re a first-time homebuyer or you’re looking to invest in real estate, purchasing a home with full cash payment is a great option. This guide will provide you with all the information you need to make an informed decision about buying a home in Florida with cash payment.

The current Mortgage Interest rates are close to 7%. Therefore, there are relatively less buyers in the market and there are potentially more advantages of buying a home in cash.

Pros & Cons of buying a home in cash

Pros | Cons |

No Mortgage Payments | Tied-up Cash |

Lower Overall Costs | Miss out on Mortgage Tax Deductions |

Increased Bargaining Power | Lower Liquidity |

Faster & Simpler Closing | Additional Expenses like Home Owner's Insurance, Property Taxes and HOA fees still apply. |

Peace of Mind | |

Investment Potential | |

The Negotiation Process

1. Research the market: It's essential to understand the current market trends and prices in the area where you're looking to buy. This information will help you determine a fair offer for the property.

2. Work with an experienced real estate agent: An experienced real estate agent can guide you through the negotiation process and provide valuable insight on how to negotiate effectively.

3. Know your limits: Determine your budget and stick to it. It's easy to get carried away in a negotiation and end up overpaying for a property, so be clear on your budget from the outset.

4. Be prepared to act quickly: When making a cash offer, time is often of the essence. Be ready to move quickly when you find a property you're interested in, as other cash buyers may be interested as well.

5. Consider additional contingencies: As a cash buyer, you may have the ability to waive certain contingencies that are typically required in a financing agreement. However, you should still consider including contingencies such as home inspections and appraisals to protect your investment.

Overall, the negotiation process as a cash buyer in Florida can be advantageous, but it's important to do your research and work with an experienced agent to ensure you're getting the best deal possible.

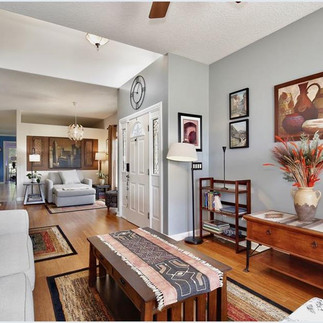

A few interior pictures of our Florida Home

The ownership was transferred to us last week. The money had to be wired to our Title company ( Celebration Title Company) along with scanned ID cards. We will received all the other documents through mail in the next 3-4 weeks.

Fun fact - we still have not seen this property. All the transactions and paper works were done online. Planning to take a trip to Orlando, FL this weekend to get the keys from our title company. :)

Cash vs Mortgage payment

This above property was listed in the market for $440,000. As cash buyers, we were able to negotiate and purchase it for $427,000. We conducted a home inspection and the property was in good condition, therefore there were no additional expenses.

In additional to this amount, we are responsible for paying the property taxes every year along with the HOA fees and Insurance. The HOA fees is a bit higher as this property is close to a lake, has a security guard and comes with free Wifi and lawn mowing service.

Cost incurred in 30 years

| Cash | Mortgage (30 year fixed) |

Amount | $427,000 | $1,112,760 (approximate with 20% down payment) |

HOA ($235 per month) | $84,600 | $84,600 |

Insurance ($1500 per year approx) | $45,000 | $45,000 |

Property Tax ($4000 per year) | $120,000 | Included in Escrow |

Total | $676,600 | $1,242,360 |

In summary, buying a home in Florida with no mortgage is a significant financial decision that requires careful consideration. It's essential to weigh the benefits and risks, opportunity costs, tax implications, and future financial goals before making the final decision.

TIP - if you find a property yourself without the help of a realtor, don't forget to negotiate on the realtor's commission & never take the first offer! ALWAYS NEGOTIATE!

Comments